This isn’t a complete interface, just a sketch of an idea. I did a job interview with a financing company and had an idea while talking UI with them.

It occurred to me that one of the hurdles to making a loan is the unknowns, how much you have to pay, when the loan will be paid off, et cetera. Most interfaces I’ve seen on credit card sites are fairly basic, saying what the interest rate is, how much your credit limit is, and so forth. There doesn’t seem to be a tool to really picture a loan, one place to juggle the variables to get something acceptable.

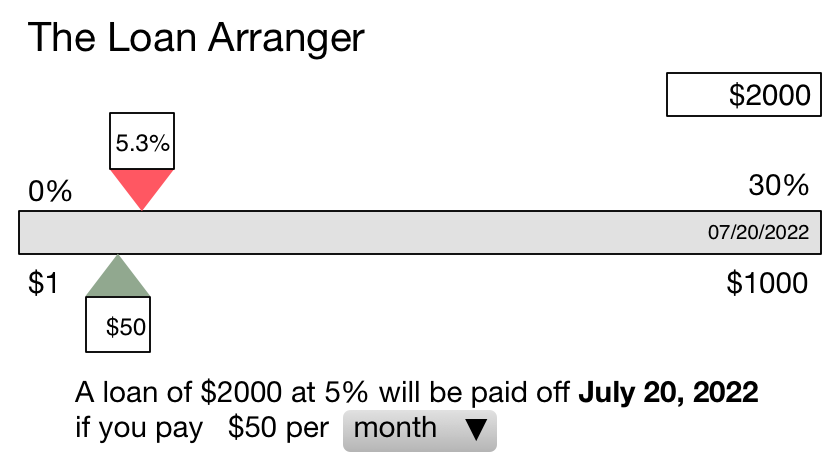

This is what I came up with. The idea is that the two sliders along a line are easily adjustable and as you adjust them, the pay off date will change based on the loan math. For example, if you slide the payment widget to the right – plan to pay more per payment – then the loan payoff date is adjusted downwards. Or conversely, if you – or more likely, your creditor – adjusts the interest rate, the payoff date would advance.

I debated which items to put into the slider. Originally I thought I’d include the principal and the payment, but I reasoned that a loan principal is usually the prime consideration in a loan decision. The interest rate is more likely negotiable than the principal needed.

I also considered making the payoff date a slider, but I really can’t picture a use case where someone has a payoff date in mind and wants to know how much at what interest rate they can get. The payoff date is more of a result than a deciding criterion.

Finally, although every loan I’ve been involved with has monthly payment cycles, to make the loan arranger complete, it needs an option to choose payments on a weekly, monthly, or annual basis. That variable is not something that lends itself to a number line, so that is left as a dropdown in the label.

I want to make sure that the reader understands that the “label” is dynamic, the text of which is changing with the use of the tools. This gets around the problem of people who might not understand the tool well, but still needs the solution spelled out in English.

Also, there is one note on order of operations here. I consider the interest rate and payment as semi-fixed, i.e. they will not move unless the user moves them. The principal amount, if changed, will only affect the payoff date, it will not change the sliders. For the unusual use case where someone wants to figure out how much they can afford and payoff by a specific date, they can put in a principal amount and then adjust the payment amount to hit the date they have in mind.

Finally, you may wonder why the payment slider ends at $1000. That’s 50% of the current principal. If you can’t figure out $2000 will be paid off in two $1000 payments, then you have more problems than this tool can solve.